8 Easy Facts About Transaction Advisory Services Shown

Table of Contents7 Simple Techniques For Transaction Advisory ServicesRumored Buzz on Transaction Advisory ServicesTransaction Advisory Services - The FactsAn Unbiased View of Transaction Advisory ServicesSee This Report about Transaction Advisory Services

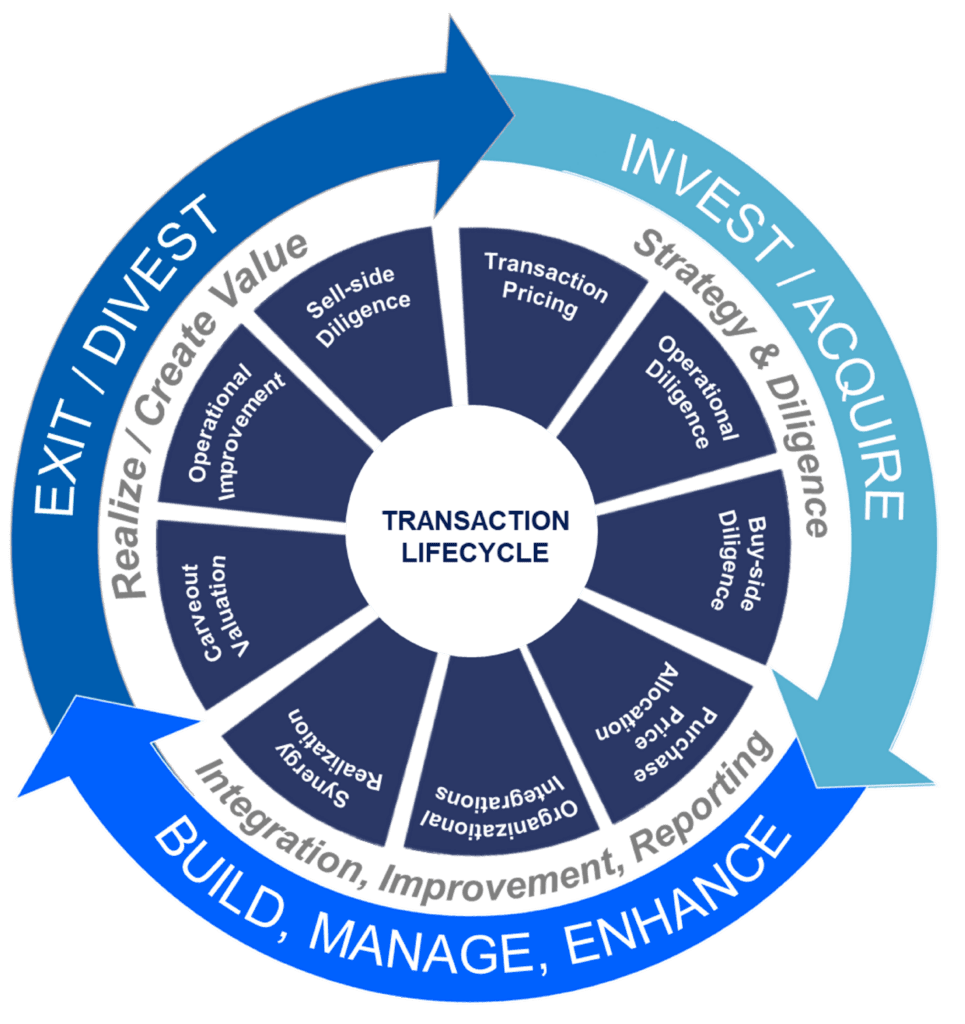

This step makes certain the organization looks its finest to possible purchasers. Getting the company's value right is critical for an effective sale.Deal advisors step in to help by obtaining all the needed information organized, responding to questions from purchasers, and arranging sees to the business's place. Transaction consultants utilize their competence to aid service proprietors deal with tough negotiations, satisfy customer expectations, and structure offers that match the proprietor's goals.

Fulfilling lawful rules is vital in any kind of business sale. They assist company owners in planning for their next steps, whether it's retirement, beginning a new endeavor, or handling their newly found riches.

Deal advisors bring a riches of experience and understanding, making certain that every facet of the sale is taken care of properly. Through strategic preparation, evaluation, and arrangement, TAS aids entrepreneur accomplish the highest possible sale price. By making sure lawful and regulative compliance and managing due persistance together with other deal staff member, transaction experts decrease prospective dangers and liabilities.

Not known Factual Statements About Transaction Advisory Services

By contrast, Large 4 TS teams: Work with (e.g., when a possible purchaser is performing due persistance, or when a deal is shutting and the buyer requires to integrate the firm and re-value the seller's Annual report). Are with charges that are not connected to the offer shutting effectively. Gain charges per engagement someplace in the, which is much less than what investment financial institutions make also on "small bargains" (but the collection chance is likewise a lot higher).

, however they'll concentrate more on bookkeeping and evaluation and less on topics like LBO modeling., and "accountant just" subjects like test balances and exactly how to stroll via events using debits and credit reports instead than financial statement modifications.

The Facts About Transaction Advisory Services Uncovered

that show how both metrics have actually transformed based upon items, channels, and clients. to judge the accuracy of management's previous forecasts., consisting of aging, supply by product, typical levels, and provisions. to determine whether they're entirely imaginary or rather believable. Professionals in the TS/ FDD groups might likewise interview management concerning every little thing above, and they'll write a detailed record with their searchings for at the end of the process.

The power structure in Deal Services varies a bit from the ones in financial investment financial and private equity jobs, and the general form appears like this: The entry-level role, where you do a whole lot of data and economic analysis (2 years for a promo from right here). The click here to read next level up; comparable work, yet you get the even more fascinating little bits (3 years for a promotion).

Particularly, it's difficult to get advertised beyond the Manager degree because couple of individuals leave the task at that phase, and you need to start revealing proof of your ability to generate profits to advance. Let's begin with the hours and lifestyle because those are less complicated to describe:. There are periodic late evenings and weekend work, however absolutely nothing like the frantic nature of investment financial.

There are cost-of-living changes, so expect lower compensation if you're in a less costly area outside significant financial facilities. For all positions except Partner, the base salary comprises the bulk of the total compensation; the year-end reward may be a max of 30% of your base income. Typically, the finest method to additional info enhance your profits is to switch to a different company and bargain for a greater income and benefit

The Ultimate Guide To Transaction Advisory Services

At this stage, you need to just remain and make a run for a Partner-level role. If you desire to leave, maybe move to a customer and perform their evaluations and due diligence in-house.

The primary trouble is that since: You generally need to join an additional Big 4 team, such as audit, and job there for a few years and then relocate into TS, work there for a couple of years and after that move into IB. And there's still no warranty of winning this IB role since it relies on your area, clients, and the employing market at the time.

Longer-term, there is additionally some risk of and because examining a firm's historical monetary details is not specifically rocket science. Yes, people will certainly constantly require to be involved, but with more sophisticated modern technology, reduced headcounts could potentially support customer involvements. That said, the Transaction Solutions group beats audit in terms of pay, work, and departure possibilities.

If you liked this write-up, you could be thinking about reading.

6 Simple Techniques For Transaction Advisory Services

Create advanced financial frameworks that assist in establishing the actual market price of a firm. Give consultatory job in connection to business assessment to help in negotiating and rates structures. Clarify the most ideal form of the bargain and the kind of factor to consider to use (money, click this site supply, earn out, and others).

Do assimilation planning to identify the procedure, system, and business changes that may be needed after the bargain. Set guidelines for integrating departments, innovations, and organization procedures.

Determine potential decreases by decreasing DPO, DIO, and DSO. Analyze the prospective consumer base, market verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance offers vital insights into the functioning of the company to be acquired worrying danger evaluation and value production. Determine temporary adjustments to financial resources, banks, and systems.